I posit these energy equities will soon soar from their current share prices based on macroeconomic, sector and company specific catalysts. The world has stepped up and taken notice of the vast value of the North American unconventional shale plays and put their money where their mouth is. I believe this trend will drive the share prices of these stocks higher. America's black gold rush is here, and these stocks are set to rally in 2012.

I posit these energy equities will soon soar from their current share prices based on macroeconomic, sector and company specific catalysts. The world has stepped up and taken notice of the vast value of the North American unconventional shale plays and put their money where their mouth is. I believe this trend will drive the share prices of these stocks higher. America's black gold rush is here, and these stocks are set to rally in 2012.

In this article, we will discuss the following stocks: EOG Resources, Inc. (EOG), SandRidge Energy, Inc. (SD), Chesapeake Energy Corporation (CHK), Cabot Oil & Gas Corporation (COG), Kodiak Oil & Gas Corp. (KOG), Hess Corporation (HES) and CSX Corp. (CSX). These companies have exposure to North American Shale plays.

Please review the illustration below detailing the plays.

Click to enlarge

Illustration provided by Merricksystems.com.

These stocks have major upside potential based on the tremendous value of their proven and unproven reserve leaseholds in these shale plays as well as some that stand to gain significant business facilitating the extraction and delivery of the products. Please review the following macro-economic positive highlights and major oil and gas market catalysts followed by company specific catalysts and a chart detailing current fundamentals regarding these buying opportunities.

2012 Macro-Economic Positive Indicators

2012 began on a strong note by recording its preeminent single-session percentage gain in weeks, closing at a two-month high. There were a multitude of positives spurring the advance. Please review the following highlights of macro-economic positive indicators.

- The manufacturing reading from China advocated activity expanded after contracting the prior month.

- India reported its best manufacturing reading in six months.

- Manufacturing data from Europe was comparatively inspiring.

- Recent manufacturing activity in the United Kingdom was better than expected.

- Eurozone manufacturing activity was somewhat in-line with outlooks.

- Progress by the euro proved positive for stocks.

- The December ISM Manufacturing Index improved to 53.9 from 52.7 in November, exceeding expectations of 53.4.

- November construction spending increased by 1.2% besting analyst estimates of 0.5%.

- The FOMC meeting minutes specified that domestic economic activity grew temperately notwithstanding seeming deceleration in growth of overseas economies and continuing monetary complications in the eurozone. The FOMC largely remains sure the speed of economic activity will increase in the coming years. Nevertheless, many members specified present and future circumstances may well merit further policy accommodation.

- Commodities advanced, taking the CRB Commodity Index 2.6% higher, its best single-session percentage gain in a quarter. Oil ascended over 4% and settled just below $103 per barrel. A weak greenback and aggressive rhetoric from Iran where seen as the primary catalysts.

Major Macro Oil and Gas Catalysts

Based on several bullish technical indicators, the market's unending resilience in the face of continual negative headlines, I believe the market is setting up for a 2012 rally. The following is a list of macro catalysts for oil and gas in 2012.

- Foreign energy companies are chomping at the bit to get in on America's black gold rush. Total (TOT) and China's Sinopec (SHI) are the most recent entrants. Total recently closed a $2.32 billion deal on a 25% stake in an Ohio shale deposit operated by Chesapeake. Sinopec recently paid $900 million and pledged to cover up to $1.6 billion in drilling costs for a 33% stake in Devon's (DVN) portfolio of properties.

- Emerging market countries (China and India) increasing strategic reserve stockpiles

- Middle Eastern instability due to Iran, Iraq and Syria. The European Union reached a preliminary agreement to ban imports of Iranian crude, intensifying strains in the West's impasse with Tehran.

- Chinese and emerging market demand growth rising

- U.S. Fed and ECB printing presses working overtime

- U.S. dollar weakness driving commodities prices higher.

- Recent drawn downs of U.S. reserves

- OPEC decision to not increase production

- The winds of political change are blowing hard these days. If the Republicans take the 2012 presidential election, energy stocks will soar.

- The eurozone seems to be taking the proper actions to calm its tumultuous financial markets. Recently bond yields of the eurozone fringe sovereigns that were rocketing higher have sunk vastly lower with the back-door liquidity injections engineered by the ECB in the form of the LTRO.

- Recent better than expected U.S. consumer confidence and manufacturing statistics.

- Interest rates are low and the Fed has confirmed its dovish stance is here to stay.

Company-Specific Catalysts and Fundamental Statistics

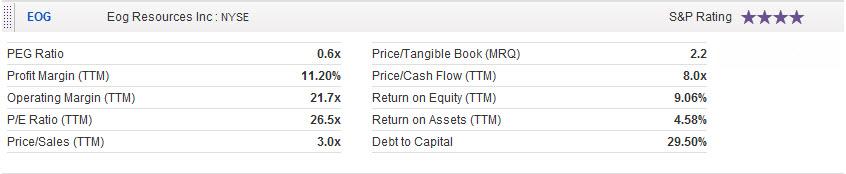

EOG Resources recently reported third quarter 2011 net income of $540.9 million, or $2.01 per diluted share. This compares to a third quarter 2010 net loss of $70.9 million, or $0.28 per diluted share.

Operational Highlights

Driven by a 64% rise in U.S. crude oil and condensate production during the third quarter 2011, EOG delivered 54% total company crude oil and condensate production growth versus the third quarter 2010. For the first nine months of 2011, year-over-year crude oil and condensate production increased 51%. The South Texas Eagle Ford led the surge in crude oil production growth, followed by the Fort Worth Barnett Shale Combo. Total company liquids production increased 49% in the third quarter 2011 over the same period in the prior year and 47% year-over-year for the first nine months of 2011.

Fundamental Statistics

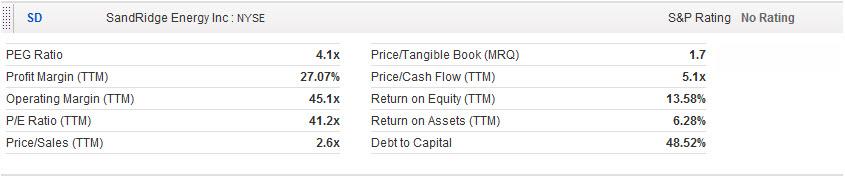

SandRidge Energy, Inc. recently announced that it has entered into a joint venture with a subsidiary of Repsol YPF, S.A., a leading international energy company based in Madrid, Spain. Under the agreement, SandRidge will sell an approximately 25% non-operated working interest, or 250,000 net acres, in the Extension Mississippian play located in Western Kansas and an approximate 16% non-operated working interest, or 113,636 net acres, in its Original Mississippian play.

Fundamental Statistics

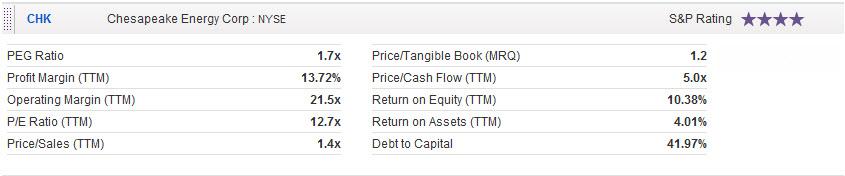

Chesapeake Energy Corporation recently announced substantial progress in achieving its long-term debt reduction goal set forth in its 30/25 Plan announced in January 2011. Chesapeake's long-term debt (net of cash) as of year-end 2011, was approximately $10.3 billion, a reduction of $1.4 billion from the September 30, 2011, level of $11.7 billion and a reduction of $2.2 billion from the year-end 2010 level of $12.5 billion.

Fundamental Statistics

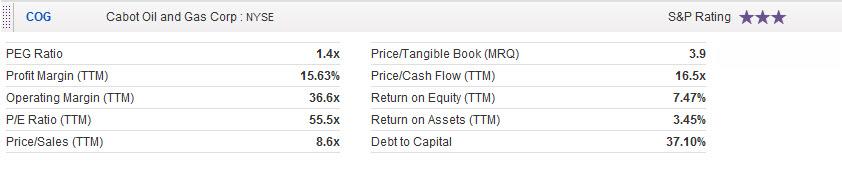

Cabot Oil & Gas Corporation recently announced a new milestone for its Marcellus production with the achievement of 606 Mmcf per day (before royalty) for a 24 hour period and an average of 600 Mmcf per day for the final two days of 2011. This level represents a 154% increase over the 2010 Marcellus exit rate of 236 Mmcf per day. Contributing to the additional volumes is a recently commissioned upgrade to the Teel compressor station that increased compression capacity to 200 Mmcf per day from 100 Mmcf per day, giving the company 650 Mmcf per day of total compression.

Fundamental Statistics

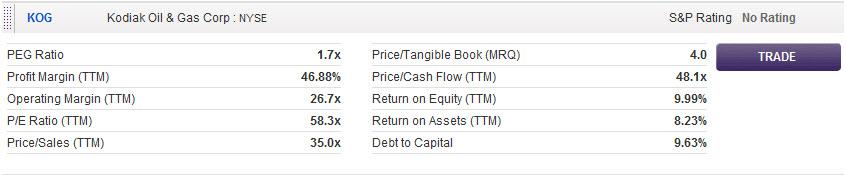

Kodiak Oil & Gas Corp. recently announced the closing of its private offering of $650 million in aggregate principal amount of senior notes due 2019 in a private placement to eligible investors. The notes bear interest at 8.125% per annum and were issued at a price of 100% of their face amount.

Fundamental Statistics

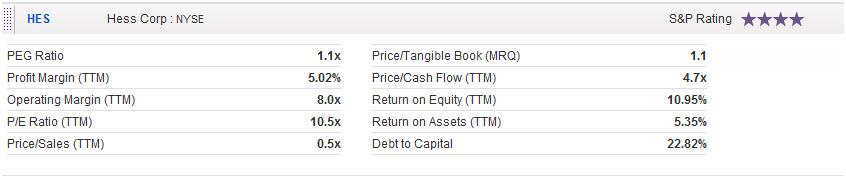

Hess Corporation recently announced that they will proceed with the development of Tubular Bells, a deep-water oil and gas project operated by Hess in the Gulf of Mexico. Annual gross production is expected to peak in the range of 40,000-45,000 barrels of oil equivalent per day. Total estimated recoverable resources for Tubular Bells are estimated at more than 120 million barrels of oil equivalent. The development is estimated to cost $2.3 billion, with additional commitments for production handling, export pipeline and oil and gas gathering and processing services. Following BOEM approval of the recent assignment of BP's interest, Hess will hold a 57.14% interest in the field, and Chevron (CHK) will hold the remaining 42.86% interest.

Fundamental Statistics

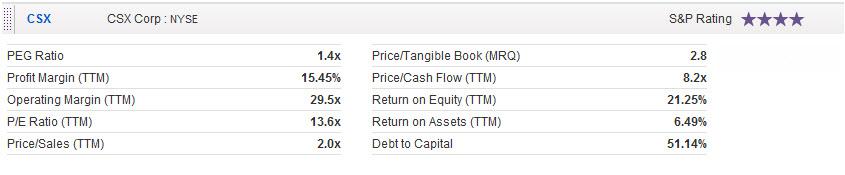

CSX Corporation recently announced third quarter net earnings of $464 million, or $0.43 per share, versus $414 million, or $0.36 per share, in the same period last year. This is a 19% improvement in earnings per share and a record third quarter for the company.

Year-Over-Year Highlights:

- Operating income improves to $878 million

- Earnings per share increases 19% to 43 cents

- Operating ratio remains strong at 70.4%

Fundamental Statistics

Conclusion

With the current tumultuous events in the Middle East bringing attention to the mounting energy requirements of emerging economies, in addition to the burgeoning necessities of the recovering developed economies, the fact that demand is outstripping supply appears to be blatantly obvious. All the easy oil and gas has been discovered, recovered, depleted and expended. We are now left with on shore "fracking" and deep sea drilling which are much more expensive endeavors, ultimately driving the price of a barrel of oil sky-high sooner rather than later.

The emerging markets of the globe are just beginning to demand their fair share on top of many other factors. Think of this fact, even with the sad state of the current global economy, we are at $100 a barrel oil. Due to the finite nature of oil resources it seems the tipping point of the oil supply/demand equation is coming to fruition. What do you think is going to occur when the economies of the world begin to recover and emerging markets gain viable traction? You can kiss $100 a barrel oil goodbye forever.

Nonetheless, this is only the first step in finding winners for your portfolio. Please use this information as a starting point for your own due diligence and research methods before determining whether or not to buy or sell a security.

Disclosure: I am long CHK.

crystal cathedral sarah vowell fire in reno kelly ripa reno wildfire reno wildfire osu

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.